Google Shopping launched as a free tool in 2002.

Since then, Google Shopping Ads have become a staple for advertisers who allocated a massive 76% of their Google Ads budget to this campaign type in 2024.

Along with the growth in global spending, there’s been a wealth of changes along the way that have determined how these campaigns are used to find new customers and drive efficient online sales.

How advertisers find success with Google Shopping ads in 2025 is determined by many factors, but before that, let’s cover off the basics.

WHAT ARE GOOGLE SHOPPING ADS?

Google Shopping (aka Product Listing Ads or Standard Shopping) is a powerful part of Google Ads inventory that allows retailers to showcase products visually when users search for specific items on Google.

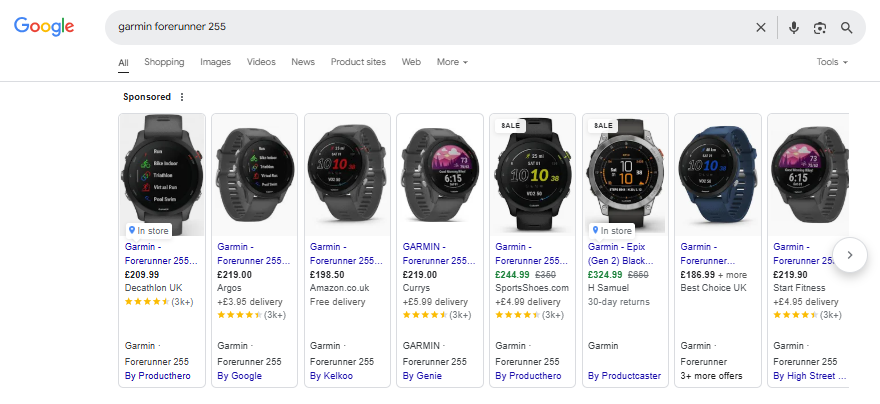

These ads appear prominently in search results and include essential information such as product images, titles, prices, and the retailer’s name, as such:

This visual campaign type helps potential customers quickly identify relevant products, offering a great shopping experience by directing them straight to the product page.

Not only do Product Listing Ads allow searchers to see the product prior to clicking through, advertisers can share a wealth of information that can help pre-qualify the click before it happens, including:

- Price

- Seller

- Shipping

- Materials

- Product/Seller Ratings

- Returns

- Promotions

When compared to Google Search Ads, studies have shown that shopping campaigns have up to 30% higher conversion rate compared to traditional text ads.

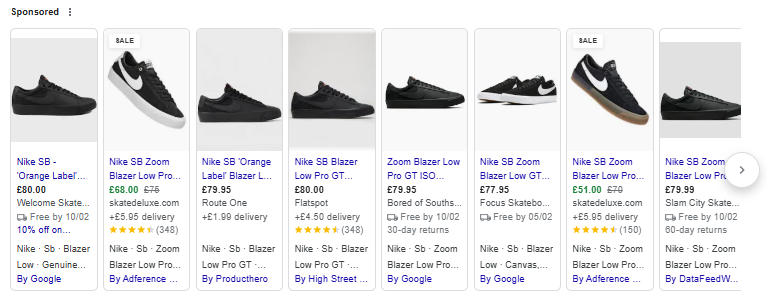

Take the search query: “black nike sb gt blazer size 11“.

Isolating the SERP to just paid ads, the person searching has either a text based ad (that they may or may not know is sponsored) which could contain the search term and/or keyword, a couple lines of text and a call to action.

Or, they can choose from a carousel of images from multiple online retailers that show the exact product they searched for, in the size they want, and some cases they will be served product listings with a promotion. Like this:

HOW DO GOOGLE SHOPPING ADS WORK?

Google Shopping Ads use product data submitted through Google Merchant Center, which is where your product feed lives.

When a user makes a Google product search, Google Ads matches the query with relevant SKUs based on this data.

There’s no keywords (aside from negatives) and the quality of the feed really does determine the auctions your products enter in, amongst other factors.

Let’s break down exactly how you can go from creating your product feed to serving ads on the Google SERP.

GOOGLE MERCHANT CENTER

At the core of Google Shopping Ads is the Google Merchant Center, where advertisers manage their product feeds.

This platform is essential for product listings, as it contains specific information and product attributes such as titles, descriptions, images, prices (and much more).

First of all, product data must comply with Google’s guidelines to ensure eligibility for advertisements, secondly, the richer your data, the better your chances of entering into eligible auctions and driving the best possible conversion rate.

One study found that having a thoroughly optimised product data feed led to a ~70% increase in ROAS and a 4.4% growth in click through rate.

Serving poor quality data or leaving your product data to simply import from your back end just isn’t good enough in 2025.

HOW ARE PRODUCT LISTINGS MATCHED TO SEARCHES?

Unlike keyword based targeting, advertisers cannot directly inform Google Ads of which queries to target.

Google uses a structured data framework to analyse your product feed to then determine which auctions you are eligible to appear in.

There isn’t one feed attribute to prioritise over others, they all have importance and differ across industries and verticals.

Take ‘Material’ for example, the importance of this field for a store selling budget t shirts vs a high end furniture manufacturer will be vastly different.

Attributes include:

- Title: This should be well planned out, prioritised, and contain essential keywords. Word ordering plays a role here too, Google only shows 70 characters so be smart.

- Description: Product information, features, specifications and context. This is where you can add the detail.

- Product Type: Get as close to your exact product as possible using the Google Ads product type taxonomy.

There’s three classifications for whether or not you need to submit the data (‘required’, ‘it depends’, and ‘optional’), but in our many years managing product listings, going bigger is better (as long the data quality is rich and consistent).

BUDGETS, BIDDING AND TARGETING

As with any Google Ads campaign, the budget and bids you set will determine how you enter into auctions for eligible search terms.

For targeting, there are controls within shopping campaigns such as:

- Negative keywords

- Campaign prioritisation

- Audiences

All have a direct link to which queries you are eligible for and how often your products enter the ad auction and strategies differ greatly across businesses.

With this campaign type being visual and eligibility for auctions much more open than a keyword based campaign, the number of impressions served can be vast (dependent on budget).

For bidding, ensure you have a clear understanding of the search query report and use negative keywords and/or campaign structuring and prioritisation to reduce workload associated with manual bidding and to provide Google with a solid platform to grow if you adopt automated bidding strategies.

HOW ARE GOOGLE SHOPPING ADS CHANGING IN 2025?

As we look ahead to 2025, Google Shopping Ads are expected to undergo significant transformations. Here are five key changes that are anticipated:

CONTINUED GROWTH OF AI

Making shopping easier.

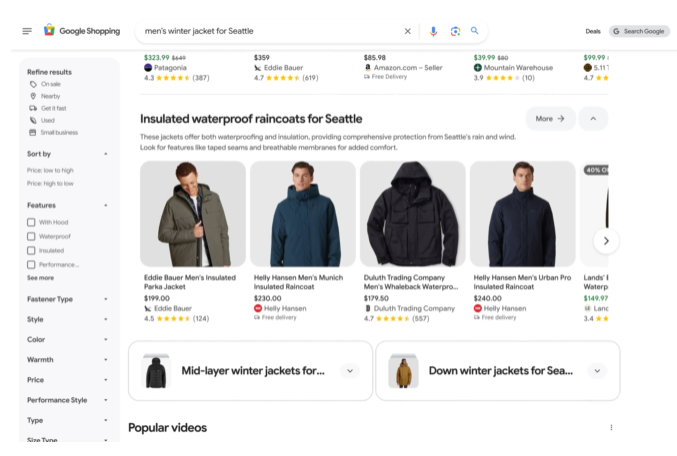

The new Google Shopping experience uses AI to intelligently show the most relevant products, with the sole purpose of making shopping easier and more personable.

Searchers now get an AI-generated brief with both considerations and a selection of SKUs to meet their needs.

An example Google provides to demonstrate this is uses the query “Men’s winter jacket for Seattle“.

Not only does this search trigger product listing ads, it also returns written content, videos, and more, to provide tailored recommendations that fit the searchers needs:

What does this mean for advertisers? Having rich product data has never been more important. Test your feed attributes, research how users are searching and how these trends change over time to take advantage of these new features.

EVOLUTION OF PERFORMANCE MAX

As of writing this post, there’s already been a wealth of new Performance Max features rolled out, including:

- Campaign-level negative keywords rolling out to all advertisers (finally)

- Brand exclusions for different formats in retailer campaigns with product feeds

- “URL contains” rules for campaigns with product feeds

- Demographic exclusions

- Device targeting

- Search terms insights source column

- Ability to segment and download asset group performance

This ever changing campaign type encompasses Google Shopping, but can be ran side by side with standard shopping campaigns.

If you’ve got the same same SKUs in both, Google will prioritise Performance Max, if not, they can exist together as part of your SEM strategy.

What does this mean for advertisers? The push from Google to adopt Performance Max and the push back from the industry to approach with caution will go on in 2025. If you’re not testing Performance Max, you should be, and if you have and get better results through Google Shopping, stick with this for now but always keep on the pulse of changes as they will come thick and fast (like the new match type: Search Max).

INCREASED COMPETITION AND COST

Analysis undertaken by LocaliQ showed that year over year in 2024 CPC’s had risen 20% across 86% of the industries they sampled, with certain sectors seeing increases as high as 25%.

Google’s chalked this down to “ongoing economic challenges like inflation“, however, with the antitrust trial last year specifically focussed around their ability to influence ad costs, many advertisers are still not convinced.

For 2025, and standard shopping campaigns in particular, costs are most likely going to continue increasing and as far as competition goes, although there will be many more advertisers entering the auction, the real change will come from Google’s strategic pricing changes.

What does this mean for advertisers? Not that it is anything new, but within platform ensure you are as efficient with spend, undertaking frequent analysis to feed into optimisation and that your product feed is as thorough as possible. From a wider perspective, as costs increase, advertisers have to truly get ingrained within their business/clients to find the true value of their media spend outside of CPA, ROAS, etc. Dive into incrementality testing, explore marketing mix models, and look at the bigger picture.

DATA, TRACKING AND PRIVACY

Another year, another wealth of tracking changes.

In 2025 advertisers are going to be faced with:

- Privacy Sandbox: Google’s Privacy Sandbox aims to replace third-party cookies with privacy-preserving alternatives. Essentially, Google are looking to serve ads based on user interests without revealing individual identities. Will this happen in 2025? Unlikely, however, after the announcement in July last year to keep third party cookies rolling, Google are not giving up on their sandbox, so stay agile.

- User Consent and Tracking: Google plans to prompt Chrome users to opt in or out of third-party cookies, shifting control to consumers. This would be hugely impactful and as with most of the cookie updates, when and how this will be rolled out is yet to be shared, so again, stay agile.

- First Party Data: This is mission critical for Google Shopping (and all Google Ads) campaigns. This data improves, audience targeting, cost efficiency, attribution, measurement, and so much more. This isn’t a change as such, more so a push if you haven’t already adopted first party data. Get your CRM integrated, leverage event based tracking (e.g. GA4) and focus on data collection.

What does this mean for advertisers? You have to stay agile and involved with developments in tracking and privacy, failure to do this will only result in a surprise update that could catch you off guard. Make first party data you priority and do everything you can to improve data collection and build out your audiences.